A Comprehensive Guide to Rich Dad Poor Dad and Accessing the PDF Version

Unlock the financial lessons of Robert Kiyosaki’s "Rich Dad Poor Dad" with this guide to wealth and mindset.

Rich Dad Poor Dad, written by Robert T. Kiyosaki, is one of the most popular personal finance books of all time. First published in 1997, the book challenges traditional views on money, investing, and financial independence. Kiyosaki uses personal stories and financial principles to offer readers a fresh perspective on how wealth is built, how it is maintained, and why the current education system doesn’t always prepare individuals for financial success. Whether you are a seasoned investor or just beginning to learn about personal finance, Rich Dad Poor Dad offers valuable lessons.

In this blog, we’ll explore the core concepts of Rich Dad Poor Dad, dive into the principles Kiyosaki shares, and discuss why this book remains so influential. We’ll also look at the availability of Rich Dad Poor Dad in PDF format, how to access it legally, and offer some key resources, such as BookSummary.io, to help you explore the book further. By the end of this guide, you'll have a thorough understanding of the book's key messages and how you can access it to start improving your financial literacy today.

Table of Contents

- Overview of Rich Dad Poor Dad

- Key Lessons from Rich Dad Poor Dad

- Comparing "Rich Dad" and "Poor Dad"

- Impact of Rich Dad Poor Dad on Personal Finance

- Accessing Rich Dad Poor Dad in PDF Format

- Resources for Enhancing Financial Literacy

- Exploring More with BookSummary.io

- Conclusion

Overview of Rich Dad Poor Dad

Published: 1997

Author: Robert T. Kiyosaki

Genre: Personal Finance, Self-Help, Financial Literacy

Goodreads Rating: 4.13/5

Rich Dad Poor Dad is an autobiographical and instructional book that contrasts the two different approaches to money that Kiyosaki learned from his "two dads": his biological father (Poor Dad) and the father of his best friend (Rich Dad). These two men had very different philosophies on work, wealth, and education. Kiyosaki's real father was a highly educated man who worked for the government and believed in working hard to earn money. On the other hand, his best friend's father—his "rich dad"—was an entrepreneur who didn't have a traditional education but built a fortune by investing and making his money work for him.

Through this contrast, Kiyosaki illustrates how adopting a wealthy mindset, learning to make money work for you, and focusing on financial education can lead to financial freedom. The book advocates for taking control of your financial destiny through investments, real estate, and entrepreneurship rather than relying solely on traditional employment.

Key Lessons from Rich Dad Poor Dad

Kiyosaki's Rich Dad Poor Dad is packed with valuable insights on how to think differently about money and wealth. Let’s break down some of the most important lessons.

1. The Importance of Financial Education

One of the main themes of the book is the importance of financial education. Kiyosaki argues that most people are taught to focus on traditional education, which often leads to working for someone else rather than learning how to build wealth for oneself. He emphasizes that financial literacy—understanding how money works, how to invest, and how to manage assets and liabilities—is often missing from school curriculums.

Kiyosaki’s Rich Dad taught him that it’s not about how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for. According to Kiyosaki, investing in financial education should be a lifelong process, and people should strive to continually learn about finances, investments, and wealth-building strategies.

2. The Difference Between Assets and Liabilities

One of the most critical lessons in Rich Dad Poor Dad is the distinction between assets and liabilities. Kiyosaki simplifies this concept by defining assets as things that put money in your pocket and liabilities as things that take money out of your pocket. While this may seem like common sense, Kiyosaki shows how many people confuse the two.

For instance, many consider their home to be an asset. However, Kiyosaki argues that a personal home can often be a liability if it's not generating income (for example, through rental income). Instead, true assets are things like rental properties, stocks, bonds, and businesses—things that generate income without you having to work for it directly.

Key takeaway: Focus on acquiring assets that generate passive income and avoid taking on liabilities that drain your wealth.

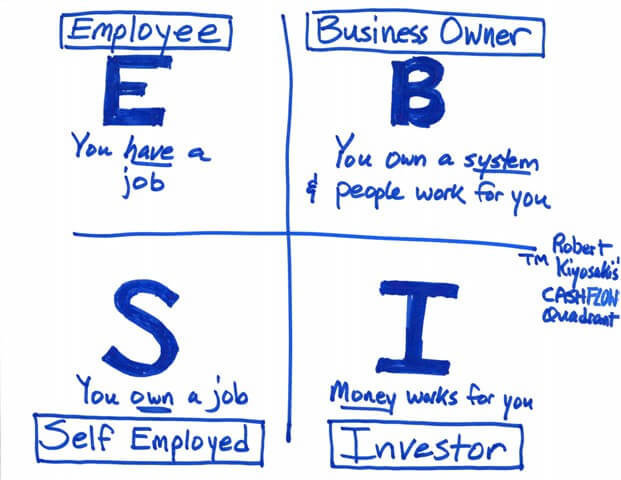

3. Understanding the Cash Flow Quadrant

Kiyosaki introduces the concept of the Cash Flow Quadrant, which divides people into four categories based on how they earn money:

S – Self-Employed: You work for yourself, but still trade time for money.

B – Business Owner: You own a business that generates income without requiring your daily involvement.

I – Investor: Your money works for you through investments that generate passive income.

The goal, according to Kiyosaki, is to move from the left side of the quadrant (Employee and Self-Employed) to the right side (Business Owner and Investor). This shift allows for greater financial independence and wealth-building.

4. The Role of Passive Income

One of the key ideas in Rich Dad Poor Dad is the importance of passive income. Unlike earned income (which you receive from working a job), passive income comes from investments and assets that generate money for you with little to no effort. Examples of passive income include rental properties, dividends from stocks, and royalties from intellectual property.

Kiyosaki emphasizes that the path to financial freedom lies in building streams of passive income. This allows you to stop trading time for money and instead have your money work for you.

5. How to Break Free from the Rat Race

The "rat race" refers to the cycle of working hard to pay bills, taxes, and other financial obligations, often with little to show for it in terms of building long-term wealth. Rich Dad Poor Dad outlines steps to escape this cycle, including:

- Shifting your mindset: Start thinking like an entrepreneur and investor rather than an employee.

- Focusing on building assets: Use your income to invest in assets that will provide returns over time.

- Managing debt wisely: Kiyosaki distinguishes between "good debt" (debt that helps you acquire income-producing assets) and "bad debt" (debt that doesn’t generate returns).

Comparing "Rich Dad" and "Poor Dad"

Kiyosaki's comparison between his "Rich Dad" and "Poor Dad" illustrates how vastly different mindsets about money can shape a person's financial destiny.

1. Different Attitudes Towards Money

Kiyosaki’s "Poor Dad" followed the conventional wisdom that working hard, getting a good education, and finding a stable job is the path to financial success. He viewed money as something you earn from working and something to be saved.

In contrast, "Rich Dad" viewed money as a tool that can be used to generate more wealth. He focused on investing, building businesses, and taking calculated risks to create multiple streams of income. He believed that it's not about working for money but making money work for you.

2. Mindset on Education and Jobs

"Poor Dad" emphasized traditional education and getting a high-paying job, believing that financial security comes from working for others. He encouraged Kiyosaki to focus on academic achievement as a route to stability.

On the other hand, "Rich Dad" taught that while education is important, financial literacy and entrepreneurship are equally, if not more, valuable. He encouraged Kiyosaki to think about how to create opportunities, invest wisely, and learn from

experience rather than relying solely on academic success.

3. Risk vs. Security

Kiyosaki’s biological father preferred financial security, opting for a steady paycheck, benefits, and the security of government work. "Poor Dad" believed that playing it safe financially—by saving money and avoiding risky investments—was the best way to ensure stability.

In contrast, "Rich Dad" embraced risk as a necessary part of building wealth. He viewed taking calculated risks—whether through investments, real estate, or starting businesses—as the way to achieve financial freedom. While "Rich Dad" acknowledged that risks could lead to losses, he believed that these risks were essential for growth and success.

Further Reading:

Impact of Rich Dad Poor Dad on Personal Finance

Since its release, Rich Dad Poor Dad has had a profound impact on personal finance education and has helped millions of readers reframe their thinking about money. The book challenges the traditional idea of working hard for someone else, advocating instead for financial independence through entrepreneurship, real estate investment, and smart money management.

Widespread Influence

Rich Dad Poor Dad has sold over 32 million copies worldwide and has been translated into dozens of languages. Its popularity has led to a series of follow-up books, seminars, and financial education programs. The ideas presented in the book have helped inspire a generation of entrepreneurs and investors to think critically about how they manage their money and build wealth.

Criticisms

While the book is widely praised for its motivational aspects and emphasis on financial education, some critics argue that Kiyosaki’s advice lacks actionable steps and specifics. Others feel that the book’s focus on risk-taking and entrepreneurship may not be applicable to everyone. Despite these critiques, the book remains a foundational text in the personal finance world.

Further Reading:

Resources for Enhancing Financial Literacy

In addition to reading Rich Dad Poor Dad, there are other great resources available for expanding your financial knowledge and applying the principles from the book to your own life.

Books Inspired by Rich Dad Poor Dad

- "The Cashflow Quadrant" by Robert T. Kiyosaki: This book delves deeper into the concept of the cash flow quadrant, helping readers understand the different ways people generate income and how to move toward financial independence.

- "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko: This book is a great complement to Rich Dad Poor Dad, as it provides insight into the habits and behaviors of America’s wealthy individuals, many of whom quietly accumulate wealth without flaunting it.

- "Think and Grow Rich" by Napoleon Hill: A classic in personal development and financial success, this book focuses on mindset and the importance of perseverance in achieving wealth and personal success.

Further Reading:

Platforms for Personal Finance Summaries

- BookSummary.io: This platform offers summaries of personal finance books, including Rich Dad Poor Dad, allowing readers to quickly grasp key concepts and ideas. BookSummary.io is ideal for those who want to get the main takeaways without reading the full text.

Exploring More with BookSummary.io

For readers who want to dive deeper into personal finance and explore the principles from Rich Dad Poor Dad without committing to a full read, BookSummary.io is an excellent resource. The platform provides:

- Concise summaries of popular books, including key points and actionable takeaways.

- Wide selection of personal finance, business, and self-help books to explore.

- Time-saving tools for busy individuals who want to improve their financial literacy quickly.

By using BookSummary.io, you can gain a strong understanding of Rich Dad Poor Dad and other financial classics, helping you to implement the lessons more effectively in your life.

Conclusion

Rich Dad Poor Dad has transformed the way millions of people think about money, work, and financial independence. By challenging traditional beliefs about education, employment, and wealth, Robert Kiyosaki encourages readers to adopt a mindset focused on building assets, generating passive income, and investing wisely.

For those looking to access Rich Dad Poor Dad in PDF format, it’s essential to do so legally and ethically through authorized retailers or borrowing services. Additionally, platforms like BookSummary.io offer valuable resources for quickly understanding the core principles of the book, making financial literacy more accessible.

Whether you’re just starting on your personal finance journey or are a seasoned investor, Rich Dad Poor Dad offers timeless lessons that can help you achieve financial freedom and success.